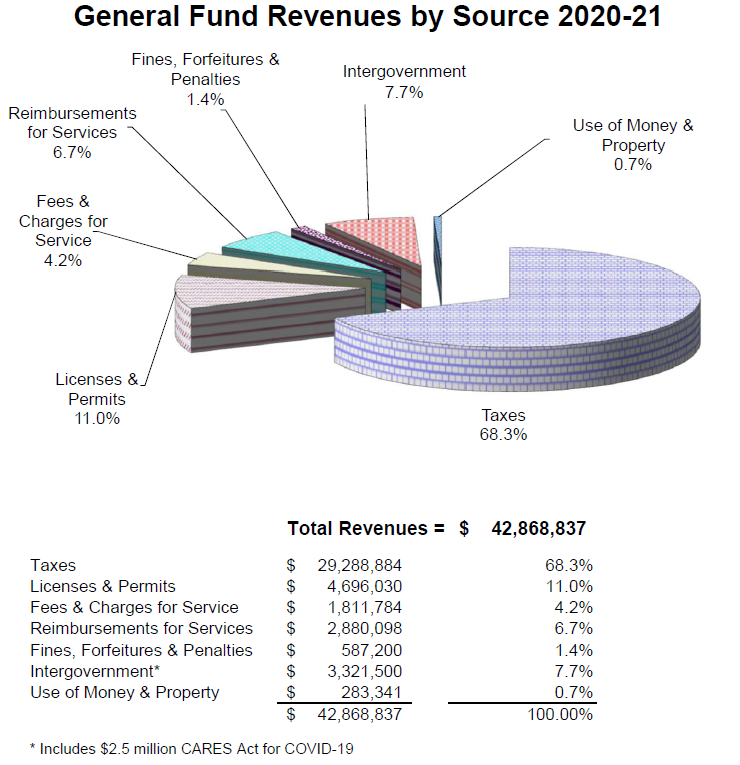

Where the Money Comes From

Where the money comes from determines how it can be spent

General Fund is used to account for money which is not required legally or by sound financial management to be accounted for in another fund.

Services Provided: Police and Fire services, administration, park maintenance, recreation activities

Enterprise Funds are used to account for self supporting activities which provide services on a user-charge basis.

Services Provided: Water and Sewer services

Special Revenue and Capital Project Funds are used to account for activities paid for by taxes or other designated revenue sources which have specific limitations on use according to law.

Example: Gas Tax, Landscape and Lighting Districts, Capital Facility Fees

Internal Service Funds are used to account for services provided internally in support of various City Departments by a department or function.

Example: Vehicle Maintenance Fund, Information Technology

Sales Tax

As with most cities in California, sales tax revenues represent the largest single revenue source for the City of Turlock's General Fund. Over the past 4 years, sales tax receipts have represented 33%- 37% of total General Fund revenues. The California Department of Tax and Fee Administration (CDTFA) collects sales and use tax receipts across the State and apportions the revenues back to local agencies based on the location of the retailer.How much of that money goes to the City of Turlock?

Of the 7.875% collected by the State for taxable sales within Stanislaus County, the State keeps 6.0%, 0.25% is allocated to County transportation funds, and 0.125% is allocated to the Stanislaus County library system. Effective on 7/1/17 0.50% is collected for Stanislaus County to fund Measure L local transportation improvements for a period of 25 years. The remaining 1% is split 95% to the City of Turlock and 5% to Stanislaus County based on an agreement negotiated with Stanislaus County.

Let's say you buy a car for $25,000. You will pay $1906.25 in sales tax. The State of CA will get $1625, the County will get $43.75, and the City of Turlock gets $237.50.

Property Tax

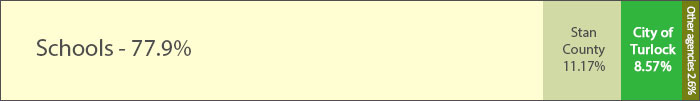

In Stanislaus County, homeowners pay 1% of the assessed taxable value of their home in property tax. This money goes to the County (11.17%), the schools (77.9%), the City (8.57%), and other agencies through tax sharing agreements (2.6%).

The current median sales price of a single family home in Turlock is approximately $352,000. The annual property tax for this home is 1% of the assessed taxable value, which in this case equates to $3,520.

Of that $3,520, the schools receive $2,742, Stanislaus County receives $393, the City receives $302, and the remaining $83 goes to other agencies through tax sharing agreements.